5 Tips When Applying For Financial Aid

1. Who can apply?

Eligible individuals:

- Are U.S. citizens or eligible noncitizens

- Possess a valid Social Security number

- Possess a high school diploma, GED or equivalent

- Are seeking an eligible degree or certificate

- Are able to maintain satisfactory academic progress

- Are not in default on a student loan or owe money on a federal student grant

- Males 17 years of age or older are registered with the Selective Service

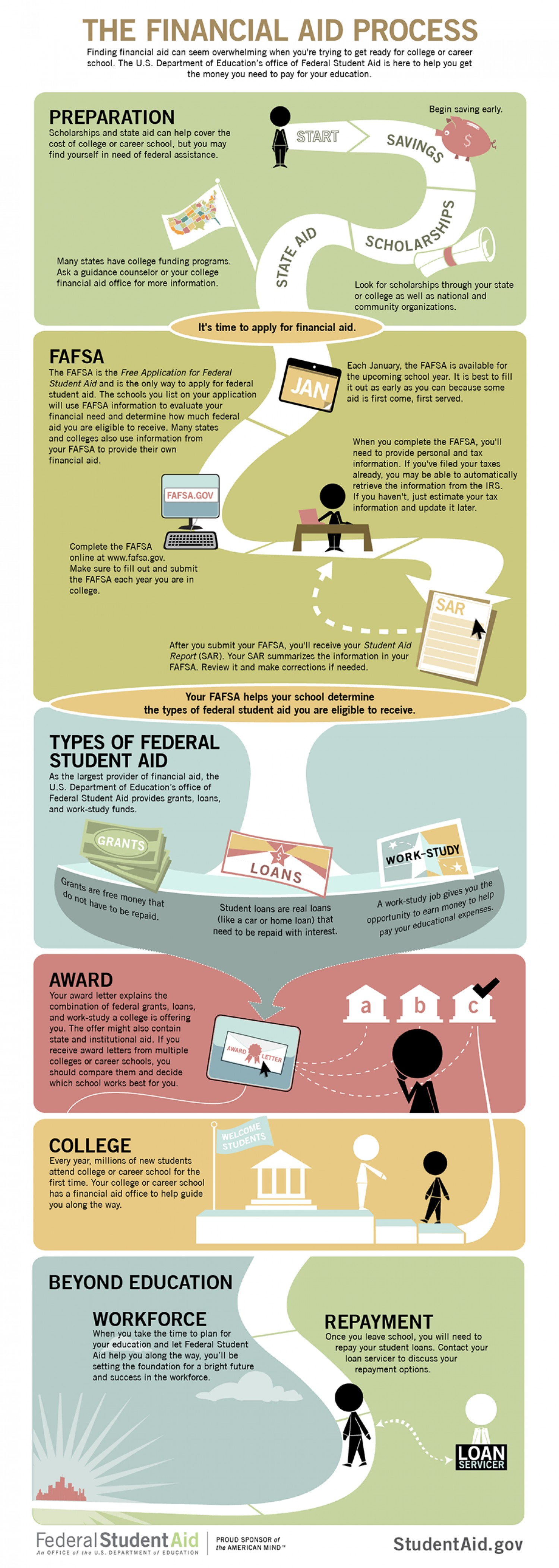

2. What types of aid are available?

Aid falls into two groups:

- Gift aid: Students do not have to repay this type of aid. Grants and scholarships fall under this group. This can be awarded based on the student information on the FAFSA.

- Self-help aid: This is earned through employment or requires repayment.

- Work-study program wages do not have to be paid back. It is paid to you as you work. You are responsible for using it towards paying for training.

- Student loans have to be repaid.

3. When do I apply?

Start early. You can complete the FAFSA as early as October 1st of each year. The aid awarded from this application is available for use in August of the same year it is completed. You must fill out the FAFSA every year you wish to receive aid.

4. Where can I apply?

The FAFSA is only available on the Federal Student Aid website. If you complete the FASFA through another website, you might get scammed.

REMEMBER: The FAFSA is always provided free of charge by the federal government.

5. Why should I apply?

The college determines a Cost of Attendance (COA). This is an estimate of student expenses. COA usually includes tuition, fees, living expenses (room and board), books and supplies, and transportation. COA will differ from college to college due to the different types of colleges, programs they offer, and living arrangements. At each college, the financial aid office will calculate your financial need.

- Financial Need = COA – Expected Family Contribution

Colleges, universities, and many vocational schools provide financial aid to students to help pay for tuition and other college-related expenses. Many times this aid does not cover the full cost. The difference between the COA and the amount of financial aid offered by the college is referred to as the gap. You and your family will be responsible for paying the “gap”.

- Amount you need to pay (gap) = COA – (Financial Aid offered by the college)

By submitting your FAFSA you can get money to help to pay for some of the “gap” expenses.

Other financial aid resources:

- Federal Student Aid

- Free Application for Federal Student Aid (FAFSA)

- Illinois Student Assistance Commission (ISAC)

- Ladder Up